The tumultuous pace of ocean freight volatility, obscene profits by carriers, post-COVID price surges, inventory bottlenecks, and the drastic shifts toward digital initiatives in the ocean freight industry have been the order of the day since 2020.

This analysis takes a look at the turn of events in global freight markets especially in the ocean freight sector and how it has panned out for the various role players in the industry.

The Ascent

The volatility of freight prices has been writhing many ways. You had one end of the industry fried from shooting prices in the post-COVID run-up to the Chinese New Year 2022.

Prices for an FEU (40′ container) had risen by as much as 5x – 15x across trade routes, leading to rattling at the top end of the supply chain. The freight forwarders felt the heat which was passed on to the cargo owners.

As if this wasn’t enough, the air sector too had swelling rates- owing to lesser freighters, no/slow unwinding of passenger air traffic, and the ports were clogged leading to air-freighting items. Trucking prices too felt the heat with driver and chassis shortages.

There was also this shift towards digital initiatives, as remote work and work from home increased. There was a need for sturdy tech-backed transaction and tracking mechanisms.

Inventory levels were clogged as supply chains were disrupted: left, right, and centre. Contracts were amended, rewritten, and rethought.

The Shipping Lines, owners, and operators saw this phase as the “ascent”.

The Descent

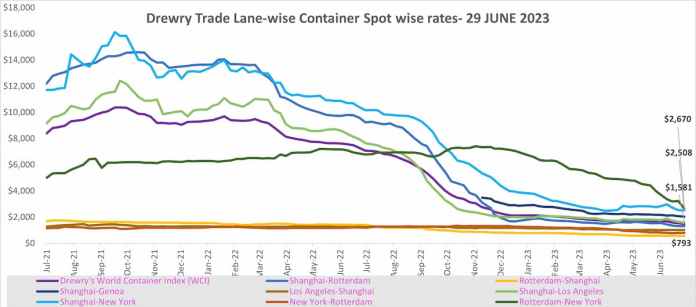

The Chinese New Year 2022 ushered in a new flip switch. Container Prices started to correct, and this started spilling over to Breakbulk and Air gradually, both having peaked in the latter half of 2022. And while the shippers waited for the Christmas influx- the holidays cheered the other end of the spectra instead.

The prices decelerated in the last quarter. The service level cancellations in the container supply chain were getting thinner. The global port disruptions which had seen waiting times at port to the tune of 45-50 days and with the waiting line of ships in triple digits, coupled with strikes and equipment shortage now saw the numbers dwindle to single digits.

With prices receiving a touch-down as of the present date across air and ocean freight the margin play has thinned or rather fanned out and operators experienced a “descent”.

The Shift

The ascent saw some lucrative earnings from the carriers. Maersk saw a profit of USD 24.02 Billion for 2021, while for 2022 it soared further to USD 29.2 billion- a figure downplayed by Q4 2022 – which saw a revenue decline to the tune of USD 686 million.

CMA CGM too raked up a net profit of USD 24.9 billion and USD 22.1 billion in 2022 and 2021, respectively. The splurge in rates drove the newbuild market which had been fueled since the pandemic further ahead.

The descent though opened doors and while Q4 of 2022 did blow some steam off from the effects that commenced from Q2, 2022 it led to huge repercussions as organizations felt that the fad in rates that was factored in was now dying.

Demand was drying up; inventories were past the thresholds and supply tightening was gradually relaxing. This led to the organizations jumping onto the safer boat of the “crescent” which was holding a pie of the end-end supply chain and in turn trying to manifest themselves as Logistics solutions providers for any piece of cargo.

Carriers expanding their footprint

While guidance and commentary for the upcoming quarters turned hawkish, there was perhaps a unanimous nod across most organizations to achieve portfolio expansion.

CMA CGM floated its Air Cargo Operations in 2021 in a low-key launch. The second half of 2022 saw Maersk and MSC launch their air cargo divisions as a stepping stone to “go beyond the oceans”.

MSC partnered with Atlas Air to deliver air cargo solutions to array its freighters while ECS Group was appointed as the general sales and services agent. Maersk had a slightly different legacy.

Though they had air cargo operations for about 35 years under the ambit of Star Air, they rebranded the initiative to Maersk Air Cargo, piloting the entity from the Billund airport hub in Denmark. They have now emphasized China-US and Korea-US operations while trying to offer Air Cargo as part of its Supply Chain package.

But that wasn’t all. The end-to-end logistics vision also needed a footprint in the areas of Logistics servicing and Project Cargo Management. Maersk did an early run up here too. They acquired the likes of LF Logistics for a pie in the integrated logistics segment.

It also acquired Martin Bencher, which upon merger and amalgamation with self, led to the official float-off of Maersk Project Logistics in May 2023. Its entities Hamburg SUD and Sealand coalesced with itself to form a larger umbrella of the brand Maersk in the integrated logistics domain.

Hapag Lloyd took a 40% stake in the Indian ports and logistics conglomerate- J M Baxi Group in early 2023 on the back of acquiring 49% in Italy based Spinelli Group- both being prominent players in the terminal and transport sector.

While MSC eyed the African market by acquiring Bollore Africa Logistics in December 2022. CMA CGM, which had a quieter time than its contemporaries suddenly let loose by expressing a USD 5.7 Billion commitment to acquire Bollore Logistics and cement its footprint in the Freight Forwarding segment.

This shopping spree by shipping lines to expand their capabilities is the current trend echoed by the views of Mr. Chen Po-Ting Chairman of Wan Hai Shipping Lines who recently commented on the company’s need for diversification into air and land transport following investments in terminals in India and Vietnam.

What about the other entities in the supply chain?

While inorganic expansion strung the news, the ports and shippers based their futures on organic growth, investing in digitalization, integrated logistics, and expansion of facilities.

Ports such as Houston, which saw record container volumes churned out each month in 2022, leading to a brief period of high congestion advocated investments in its cranage capacities. There was also a general expansion seen across some ports to have dedicated yards for the handling of empty containers.

Abu Dhabi Ports from the ports sector had also stepped up their inorganic expansion as they acquired Noatum, a global integrated Logistics platform for USD 681 million on the back of acquiring Global Feeder Shipping LLC.

Divestment

However, while investment has been the near norm, the notion of “divestment” was also seen. The containership leaders – MSC and Maersk decided to end their 2M alliance. The shipping service will see itself terminate in 2025, when the ten-year association comes to an end.

The disbanding of the 2M alliance may be a win-win situation for ocean carriers as it helps them recalibrate their strategies for expanding their customer base given that its objectives of increased capacity seem to have been achieved and both have grown beyond a simple alliance. Incidentally, 2M Alliance has had the least amount of service cancellations over the past 6-8 months.

Conclusion

The underlying trend so far has been to clutch a share of the pie and expand the base across sectors and services while also maintaining an edge in technology and customer centricity so as to stand out and become the preferred logistics partner.

The cycle of ascent and descent is set to continue, albeit with different levels of swing and volatility.

While the short-term scenario warrants a wait and watch, it remains to be seen how the investments in the crescent will bear fruit or if it was an unchecked spree of spending the excess cash on books that lingered owing to the multi-fold surge in ocean freight levels.

With Beneficial Cargo Owners (BCOs) and the top-end of the supply chain seemingly negotiating on resetting the contract rates for ocean freight, it seems ocean carriers have been moving strategically towards forming long-term alliances that can help stand on top of the competition.

The next couple of years sure seem interesting with newer regulations, newer and larger vessels, new technology, better facilities, and co-opetition (a mix of cooperation and competition).