There is a lot hue and cry happening in the exporter circle about the withdrawal of exemption of goods and services tax (GST) on international outbound ocean and air freight. Amid the looming threat of the global recession, most of the exporters are in fact assuming further squeeze in the margins, as GST exemption has become a thing of the past now.

But contrary to the popular belief, exporters may in fact benefit from the move. Let us understand the arithmetic of the same.

The current scenario

The pandemic resulted in severe supply disruption across the globe, and as result the freight rates are much higher today than it was during pre-pandemic. The freight rates are yet to come back to pre-pandemic levels and ne ..

Amid all these, non-extension of the period of exemption of GST on Outbound International Freight has come into effect from 1st October 2022. Now, Outbound ocean freight is taxable @5% subject to the condition that Input Tax Credit (ITC) on goods (other than on ships, vessels including bulk carriers and tankers) has not been taken; OutboundOcean freight is taxable @18% incase entire ITC is taken. International Air freight is always taxable at 18%

The question is that whether exporters really need to be concerned or they need to see opportunity in the withdrawal of this GST exemption.

The likely relief

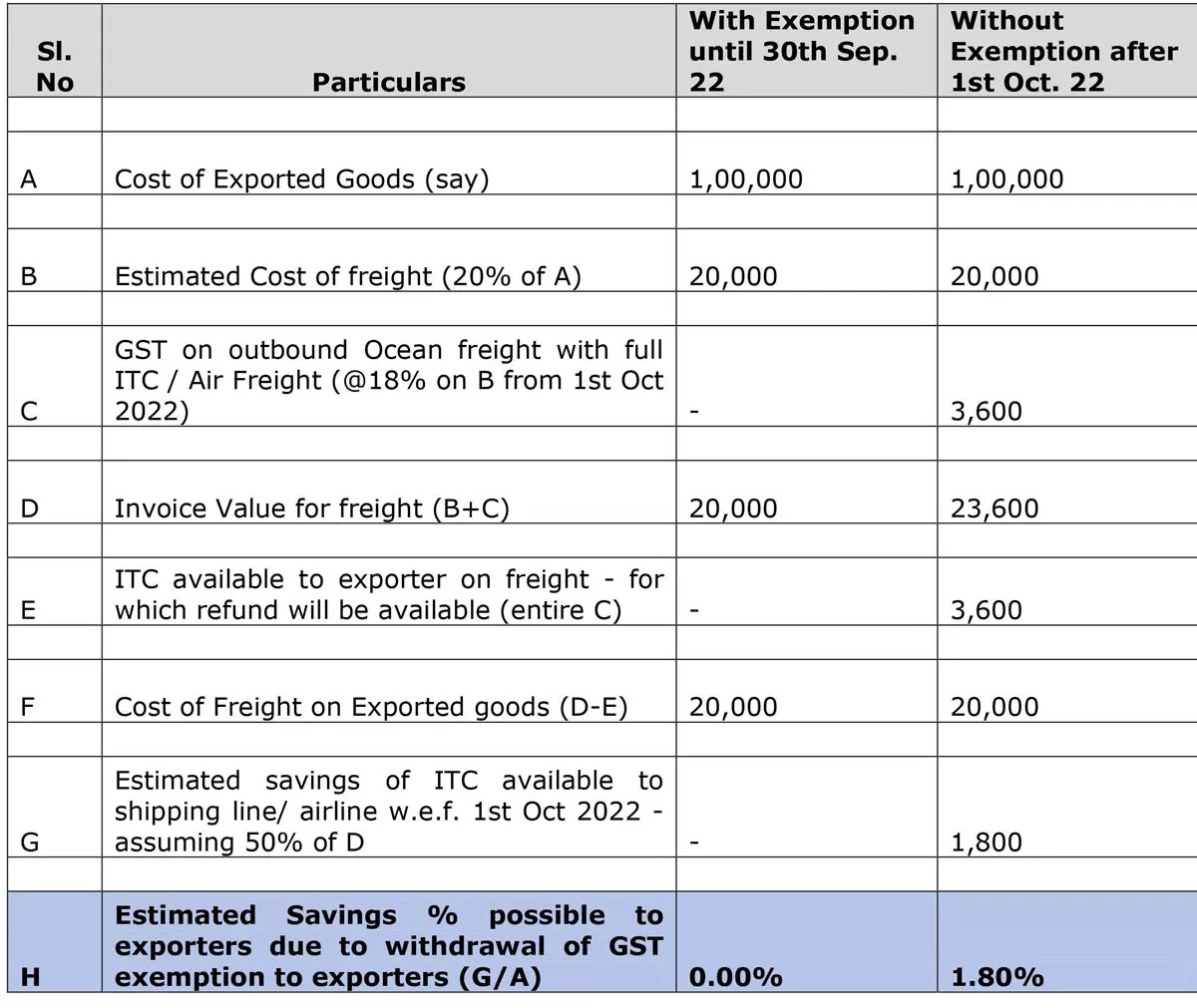

Assuming that Freight expenses are 20% of the Cost of Materials, the increase of GST element is commonly expected to hit the export prices of goods by 2% – 3%.

However, the negotiating point for exporters is the Input Tax Credit (ITC), which will now be available to the Airline/shipping line. It is important to note that when GST was exempt, the Airline/shipping line was not getting any Input Tax Credit on the capital goods/ Inputs and Input Services received by it.

But now, they would be getting either a part or entire ITC of GST on capital goods/ Inputs and Input Services used by them for rendering their services. Hence the ITC would be available to Airlines/shipping lines on all or part of items like ships, vessels including bulk carriers and tankers, services of consultants and other service providers and goods used for their business. Hence, to this extent the rates of freight may be negotiated. Even incase the cost of capital goods/ Inputs and Input S ..

As far as GST charged by the shipping line or airline is concerned, the exporter can take Input Tax Credit (ITC) of the same and thereafter claim a refund of the same. The refund mechanism under GST isnow smooth and fast and generally refunds are processed within sixty days of the filing of the refunds.

Accordingly, exporters who negotiate with their airlines/shipping lines can actually gain from the lifting of the exemption, by getting necessary tweaks in the freight charged by them. Further timely application and processing of refunds would mean that the lifting of the GST exemption would serve its purpose which is to rationalize the tax structure and avoid cascading of taxes by reducing exemption

The above arithmetic can be understood by means of the following example